Precision & Visibility for Smarter Financial Management

By: adminStruggling with Accruals? Use N2Lab’s Accrual Engine to unlock efficiency & accuracy in Accrual ManagementWhat Are Accruals?

Accruals record expenses incurred but not yet paid, ensuring financial statements reflect actual liabilities. They can be linked to a Purchase Order or created independently, offering flexibility for businesses.

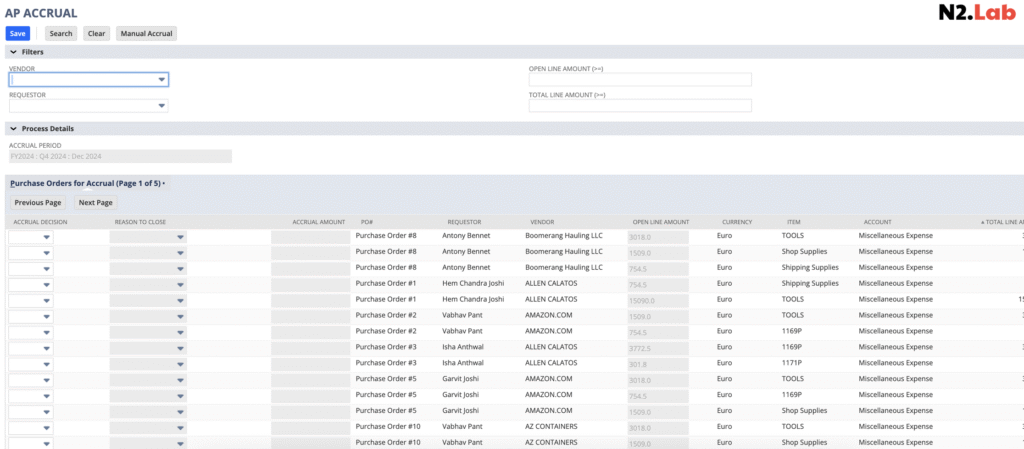

Take control of your financial obligations with the N2 Accrual Engine. Whether you need to generate accrual entries directly from a Purchase Order (PO) for each period or create standalone monthly accruals, our solution ensures accuracy and transparency. Each accrual entry is uniquely tied to its period, providing clear visibility into financial commitments. Easily track and manage accruals within POs, improving financial forecasting and compliance while reducing manual effort.

Why Are Accruals Important?

- Financial Accuracy – Ensures that financial statements reflect actual business operations.

- Regulatory Compliance – Meets accounting standards such as GAAP and IFRS.

- Budgeting & Forecasting – Helps in tracking commitments and controlling spending.

- Profitability Management – Prevents inflated profits by recognizing costs when incurred.

Common challenges faced by businesses.

- Data Discrepancies – Missing or incorrect information from purchase orders, invoices, or service agreements.

- Manual Workload – Reliance on spreadsheets and reconciliation efforts.

- Delayed Entries – Late or missed accruals causing financial misstatements.

- Approval Bottlenecks – Ensuring accruals are reviewed and authorized at multiple levels.

- Audit Risks – Difficulty in tracking and justifying accrual entries.

Take control of your accruals today by choosing N2Lab Accrual Engine!Why Choose us? The Key to Accurate Financial Management

- Role-based access ensures users can only view and manage accruals based on their assigned classifications (Class, Location, Department, Subsidiaries).

- Enabling users at different levels (e.g., AP Analysts) to create accruals based on dimensions such as subsidiary, department, and location.

- Requiring approvals from accrual owners before finalizing accrual entries.

- Providing real-time visibility into accruals on POs, improving financial tracking and decision-making.

- Ensuring no direct GL impact from accrual entries until an Accrual Journal Entry (JE) is created at the end of each period.

- Automatically reversing the Accrual JE the next day, streamlining financial reporting and reducing manual adjustments.